Some Known Incorrect Statements About Stonewell Bookkeeping

Wiki Article

Some Ideas on Stonewell Bookkeeping You Should Know

Table of ContentsStonewell Bookkeeping Can Be Fun For AnyoneThe Ultimate Guide To Stonewell BookkeepingThe 5-Minute Rule for Stonewell BookkeepingTop Guidelines Of Stonewell BookkeepingAll about Stonewell Bookkeeping

Here, we answer the question, how does accounting assist a company? In a feeling, accountancy publications represent a picture in time, however only if they are updated commonly.

It can also solve whether to enhance its very own payment from clients or customers. Nonetheless, none of these final thoughts are made in a vacuum as valid numeric information must copyright the monetary decisions of every small company. Such data is put together through accounting. Without an intimate expertise of the dynamics of your money flow, every slow-paying customer, and quick-invoicing lender, ends up being an occasion for anxiety, and it can be a laborious and dull job.

You understand the funds that are available and where they drop short. The information is not constantly great, but at least you recognize it.

The Buzz on Stonewell Bookkeeping

The labyrinth of deductions, debts, exemptions, routines, and, of course, penalties, suffices to just give up to the IRS, without a body of well-organized documentation to sustain your insurance claims. This is why a committed bookkeeper is important to a small company and deserves his or her weight in gold.

Your service return makes claims and depictions and the audit focuses on confirming them (https://swaay.com/u/stonewellbookkeeping77002/about/). Great bookkeeping is all concerning linking the dots between those depictions and truth (best home based franchise). When auditors can follow the information on a journal to receipts, bank declarations, and pay stubs, among others documents, they swiftly learn of the proficiency and integrity of the service organization

Stonewell Bookkeeping Can Be Fun For Anyone

Similarly, haphazard accounting includes in stress and anxiousness, it also blinds organization owner's to the possible they can recognize in the long run. Without the information to see where you are, you are hard-pressed to establish a destination. Just with reasonable, comprehensive, and valid data can an entrepreneur or management team story a course for future success.Local business owner understand best whether a bookkeeper, accountant, or both, is the ideal option. Both make essential payments to an organization, though they are not the exact same profession. Whereas an accountant can collect and arrange the details required to sustain tax obligation preparation, an accounting professional is better fit to prepare the return itself and really assess the revenue statement.

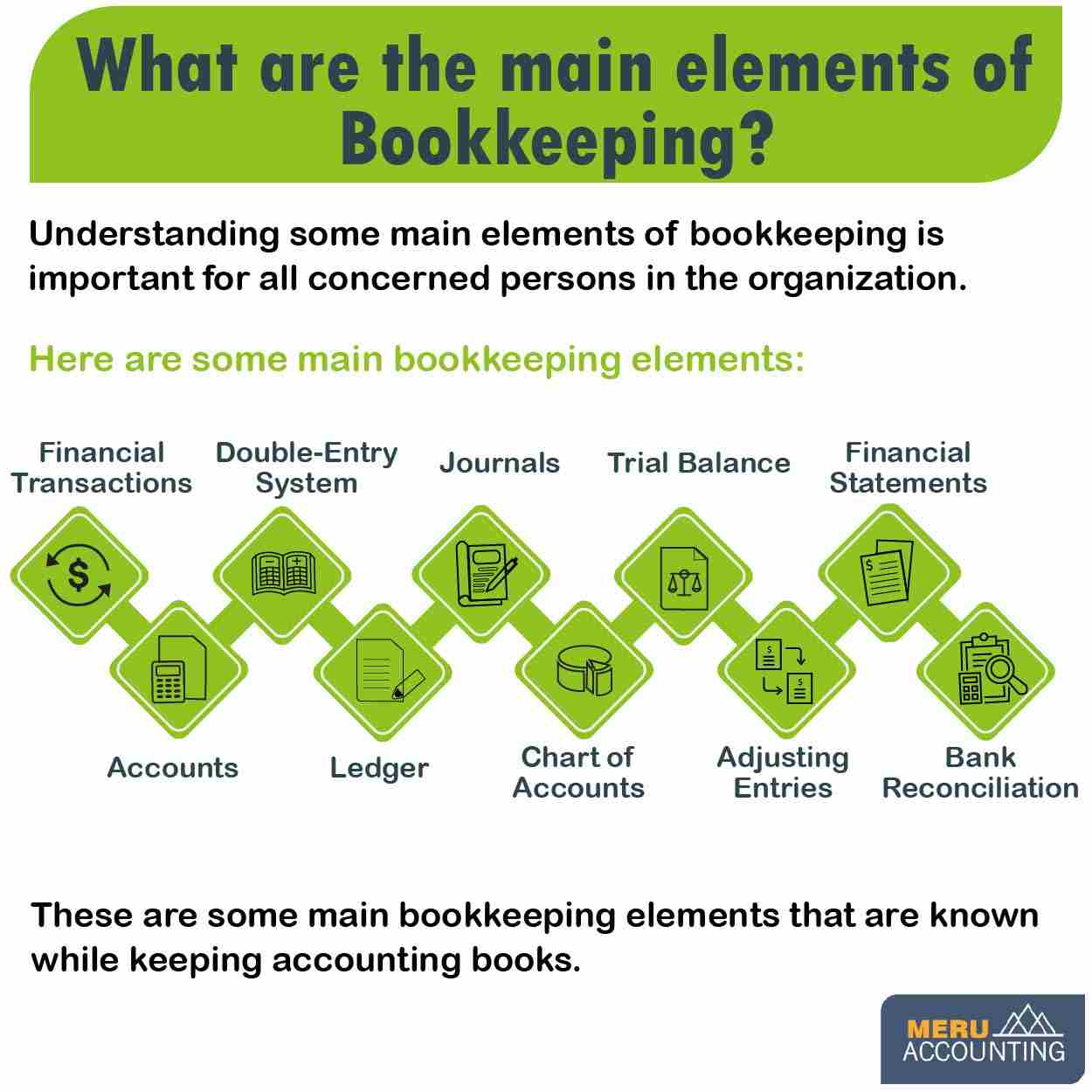

This post will dig into the, consisting of the and how it can benefit your service. Bookkeeping involves recording and organizing monetary transactions, including sales, purchases, payments, and receipts.

This post will dig into the, consisting of the and how it can benefit your service. Bookkeeping involves recording and organizing monetary transactions, including sales, purchases, payments, and receipts.By consistently upgrading monetary documents, bookkeeping aids services. Having all the economic details easily accessible keeps the tax authorities completely satisfied and stops any type of final frustration throughout tax filings. Routine bookkeeping ensures properly maintained and organized records - https://www.quora.com/profile/Stonewell-Bookkeeping. This assists in conveniently r and saves companies from the tension of searching check out here for papers throughout deadlines (Accounting).

Stonewell Bookkeeping - An Overview

They are primarily concerned concerning whether their money has actually been utilized effectively or otherwise. They definitely need to know if the business is generating income or otherwise. They likewise wish to know what potential the service has. These facets can be easily taken care of with bookkeeping. The earnings and loss declaration, which is ready consistently, shows the revenues and likewise determines the prospective based on the revenue.By keeping a close eye on financial documents, businesses can set reasonable objectives and track their progression. Routine accounting ensures that services stay compliant and stay clear of any penalties or legal problems.

Single-entry bookkeeping is straightforward and functions best for little services with couple of deals. It does not track properties and responsibilities, making it less comprehensive compared to double-entry bookkeeping.

Getting My Stonewell Bookkeeping To Work

This can be daily, weekly, or monthly, relying on your service's dimension and the quantity of purchases. Do not hesitate to look for aid from an accounting professional or accountant if you discover managing your monetary documents challenging. If you are seeking a free walkthrough with the Bookkeeping Solution by KPI, contact us today.Report this wiki page